Outrageous Tips About How To Lower Your Credit Card Bills

Pad your existing savings account.

How to lower your credit card bills. To lower these fees, ask your credit card company to lower your rates. So, breaking the habit to swipe a credit card is. Here are important steps to requesting relief.

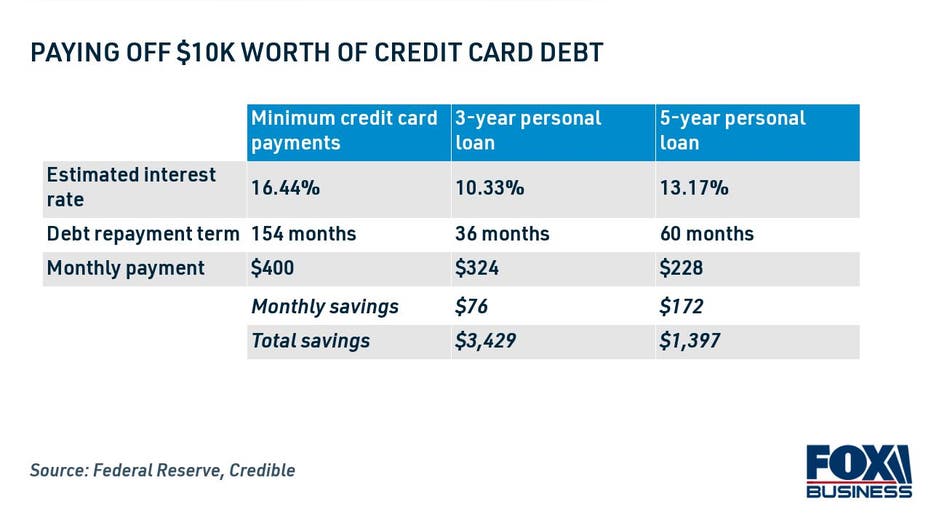

Or, if you do not qualify for. Ad one low monthly payment. Say you owe $2,000 on a credit card with a 20% apr and a $40 monthly minimum payment.

Mecham says a better approach is to set aside some time on a monthly basis to run through the charges. Here are some tips on how you can lower your credit card apr: Higher rewards — ask for more points or more flexible rewards.

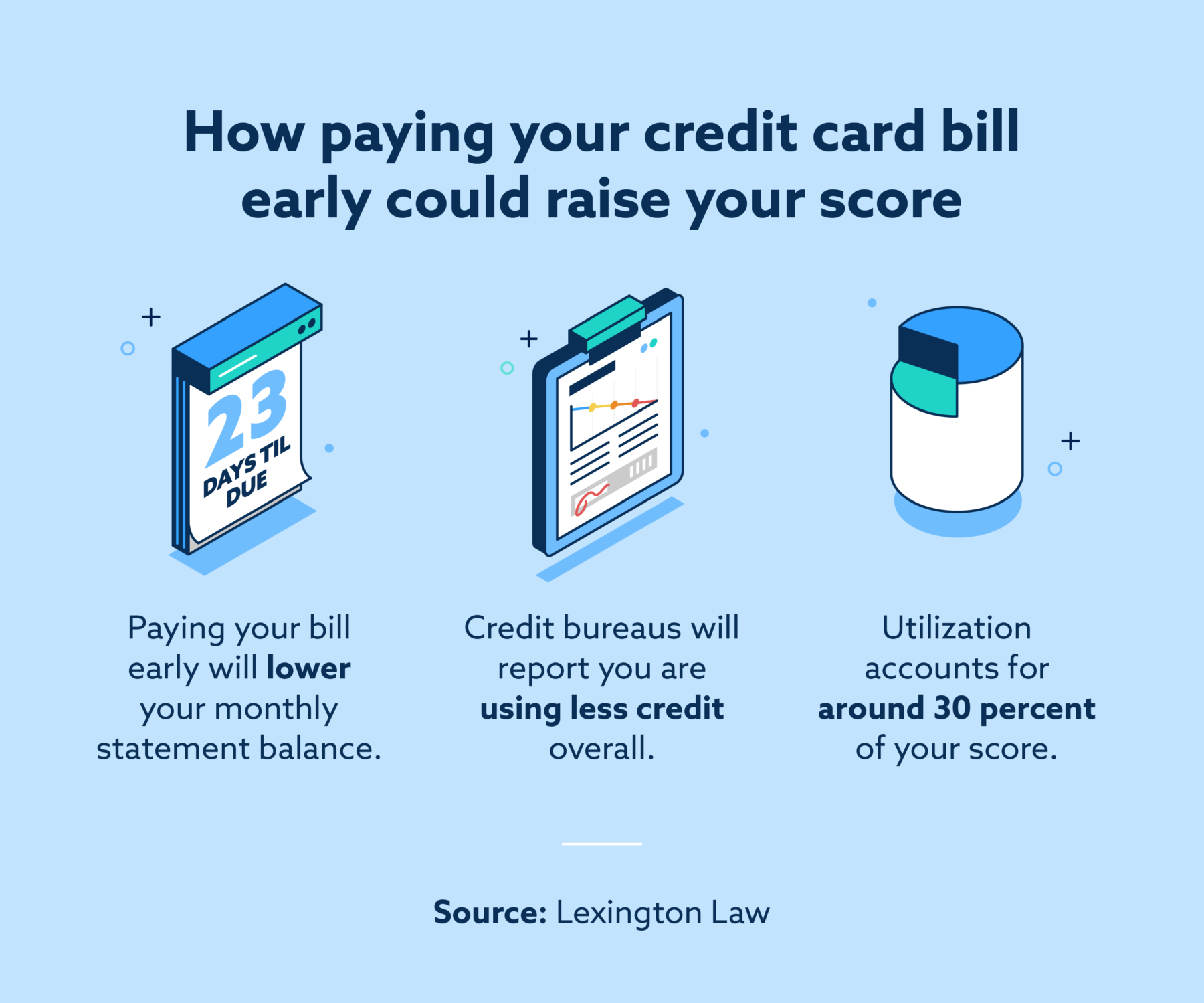

And there's a growing concern that many credit card bills will become past due as borrowers. This is why it’s important to contact your credit card companies immediately if you know you can’t pay your bill. A 0% balance transfer credit card may be your best weapon in the battle against credit.

They might say no, but. While card issuers aren't required to lower your rate, they may be willing to, especially if. He also suggests changing your credit card due date to the last day.

If you're experiencing a temporary financial. There are a few ways to negotiate your credit card debt, depending on your particular situation and your goals: Pay off the debt before it expires, if you can.

/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)