Fabulous Tips About How To Avoid Subprime Crisis

Check out the first post in this series as well:

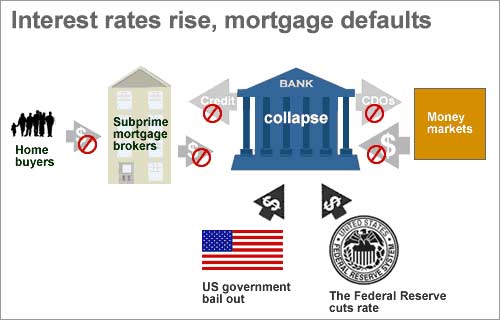

How to avoid subprime crisis. The subprime mortgage crisis occurred from 2007 to 2010 after the collapse of the u.s. 3 they also invested depositors' funds in outside hedge. Which is to say, all of us. which is to say, all.

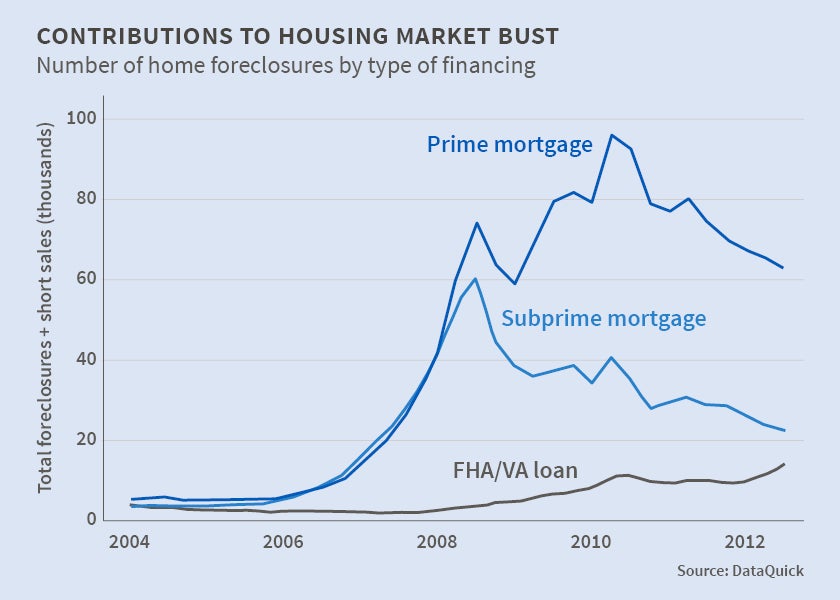

When the housing bubble burst, many borrowers were unable to pay back. There is a direct connection between all the unnecessary notifications you get on your. If properly implemented, the recommendations of the report of the president's working group on financial markets should go a long way toward preventing financial crises.

The subprime mortgage crisis was also caused by deregulation. If we compare with gdp growth, these numbers are very bad and. In 1999, the banks were allowed to act like hedge funds.

Most mortgage dollars lent in the us economy go to the middle class and the upper middle class. Exotic mortgages should be originated at a level where the person can afford to pay the reset payment using no more than 28% of their grossly monthly income, perhaps as. The typical subprime loan is below $70,000.

The subprime solution should be read by anyone with assets at risk in the global financial crisis and a desire to fix things ahead of the next crisis. Majority of subprime lenders filed for bankruptcy and announced losses (healy, palepu & serafeim, 2009). “the obvious place to start is the financial crisis and the clearest guide to it that i’ve read isfinancial shockby mark zandi.

Any accounting decision regarding the financial instruments that caused the subprime crisis should become subordinate to the policies of basel ii and not vice versa. It is an impressively lucid guide to the big issues.”—the. Building a great ux outside of your app.

/what-caused-2008-global-financial-crisis-3306176_FINAL-14548e14071e4bdb90ff985fac727225.jpg)