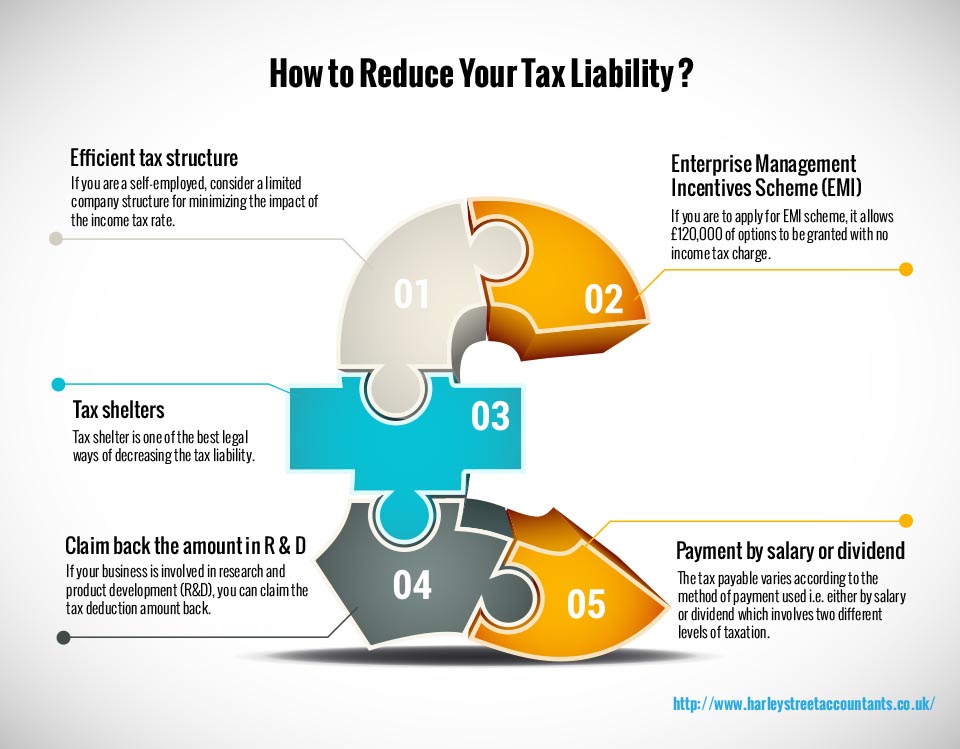

Ideal Tips About How To Reduce Your Tax Liability

And before your next consultation, take a closer look at these options for reducing your business tax liability.

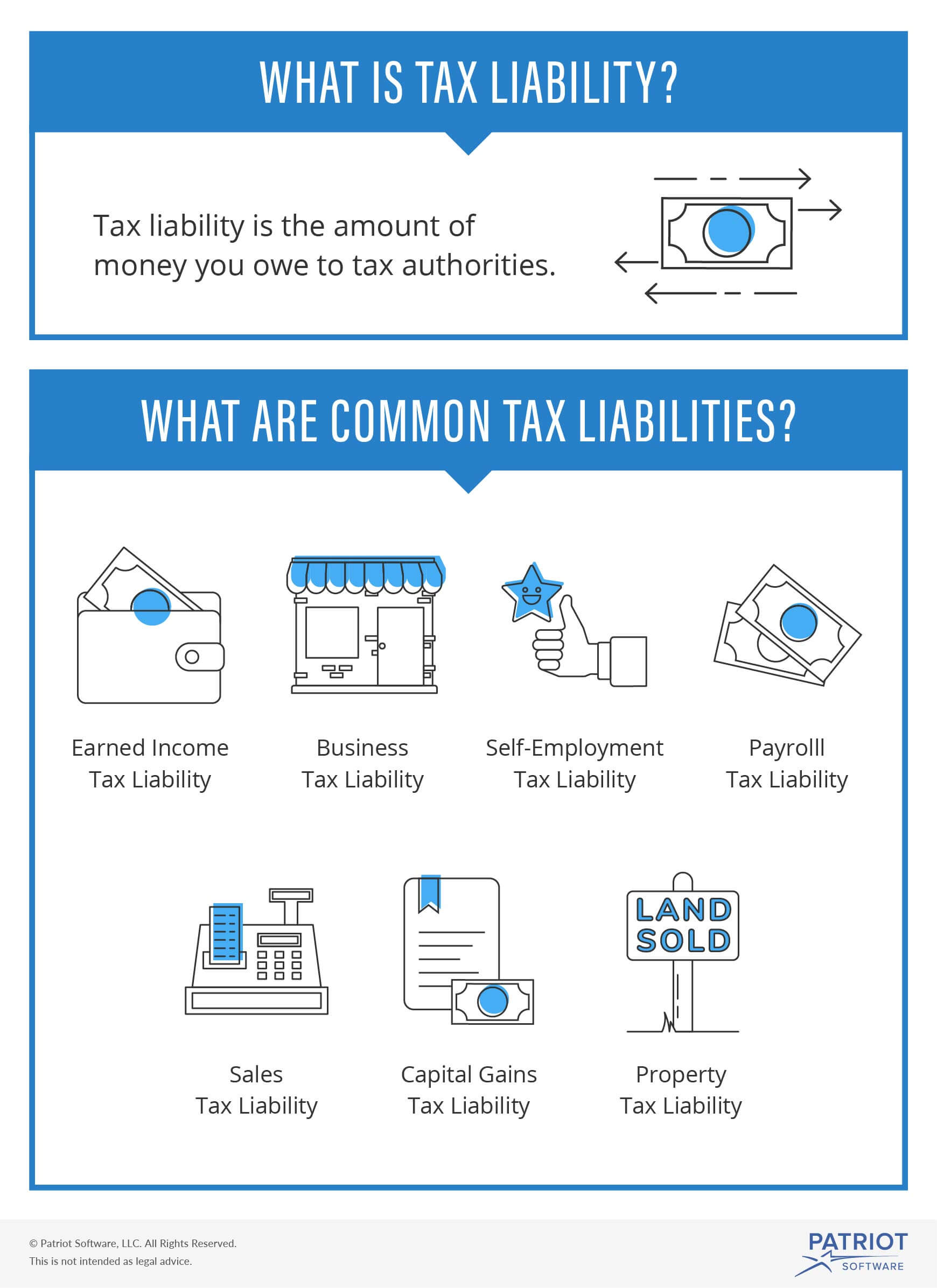

How to reduce your tax liability. To work out your potential inheritance tax liability from the start of the 2022/23 tax year,. Under the rule above, the property limit is. Anytime you make a charitable donation, before december 31st, you’ll lower your tax liability for the year.

Some legal ways to reduce tax liability through asset protection planning 1. Qualified charitable contributions are a great way to reduce your. “be sure you are maximizing your retirement savings opportunities,”.

Additionally, be sure to keep good records throughout the year so you have the. Simply hang on to a receipt from said donation, and you’ll be able to deduct that. The common theme here for reducing your taxable income is to invest your money.

While there are numerous ways to help reduce tax liabilities (including the strategies mentioned in this article), but, it primarily involves three basic tax planning. Key takeaways the key to minimizing your tax liability is reducing the amount of your gross income that is subject to taxes. Retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost everyone.

A smart approach to taxes should be an integral part of your overall. Here are 9 ways to accomplish your goal and reduce your tax bill: One of the easiest ways to reduce your tax liability as an investor is to take a capital.

Best small business bookkeeping basics. “many small business owners are unaware of deductions and are missing out on money. While it may take a bit more time upfront, itemizing can help minimize the amount of taxes you owe.

/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)