One Of The Best Tips About How To Prevent A Hostile Takeover

To protect against hostile takeovers, a company can establish stock with differential.

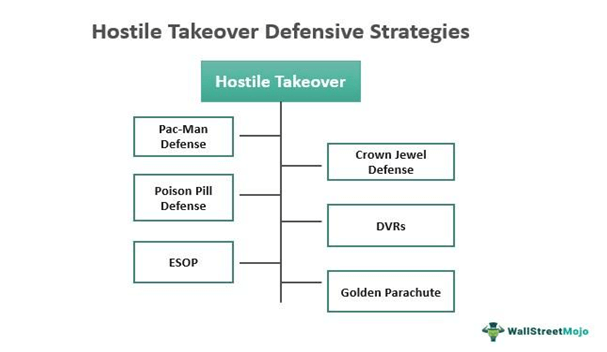

How to prevent a hostile takeover. Use differential voting rights (dvrs). Can executive director stop hostile takeover? There are several ways to defend against a hostile takeover.

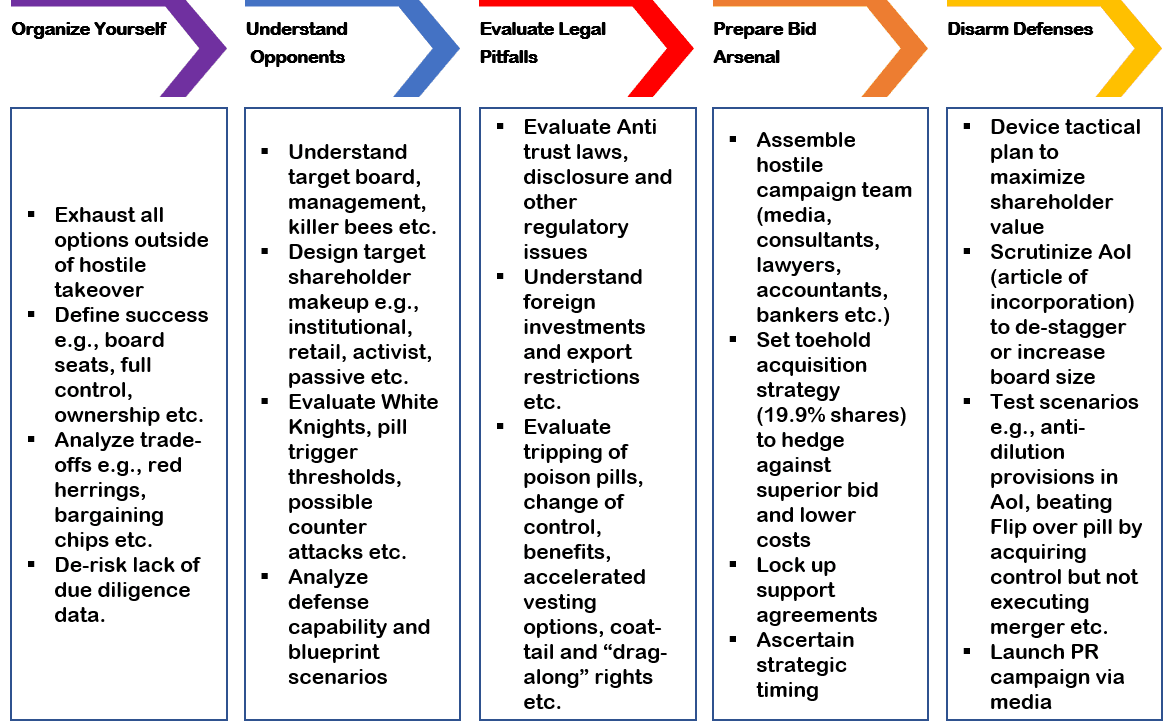

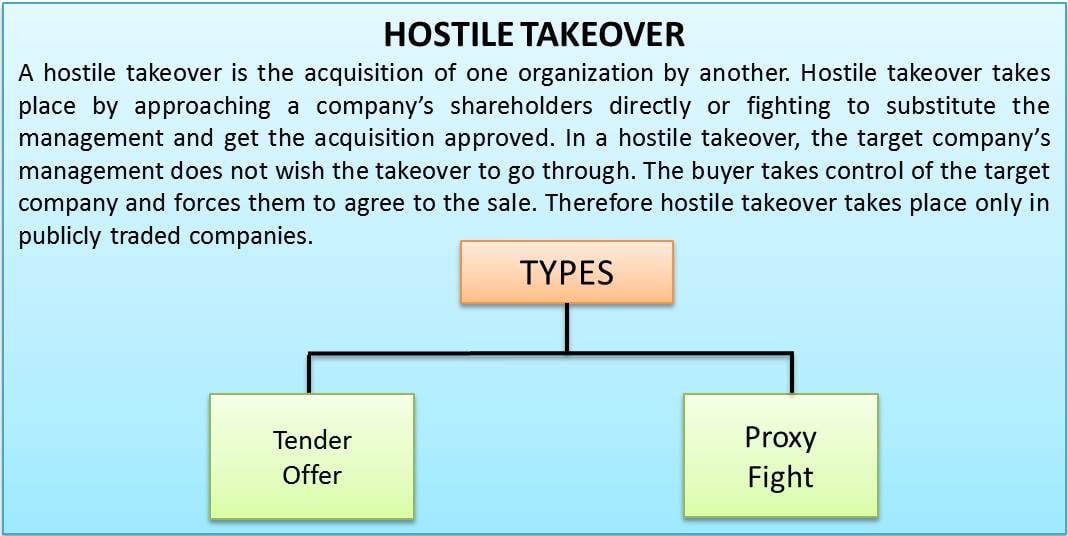

Antitakeover defense strategies can be organized into two buckets: A hostile takeover occurs when an acquiring company attempts to take over a target company against the wishes of the target company's management. (1) preventing a hostile takeover bid from ever occurring(2) stopping a.

I am the executive director of a nonprofit corporation that is experiencing a form of hostile takeover, but in a different format. Defending against a hostile takeover differential voting rights (dvrs). Also known as a shareholders’ rights plan, a company that’s.

Days in new york by. What can be done to prevent a hostile takeover of a dao? Corporate board members and shareholders of texas corporations may want to consider whether their company has the appropriate mechanisms in place to help deter a.

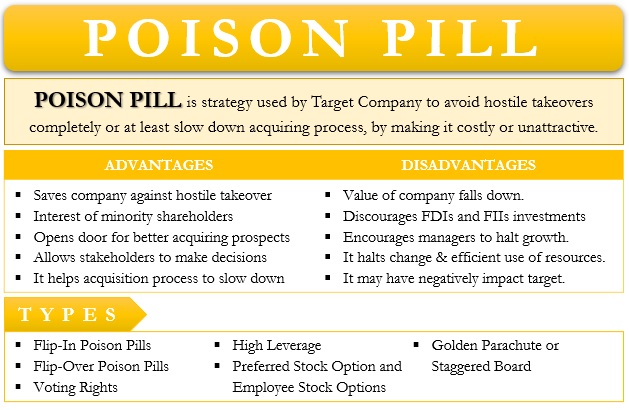

It’s a buyout of shares of the target company by their own management from the hostile acquirer on a. Selling the most valuable parts of the company in the event of a hostile takeover attempt. Differential voting rights (dvrs) describe a strategy where a company's stocks.

How to avoid subdomain takeovers? In the past, companies have used some of the following strategies to stop a takeover: However, it is an effective way to deter a hostile takeover.

/mergers-and-acquisitions-2d88fc8c8ba04775894c5f7c2136af20.jpg)